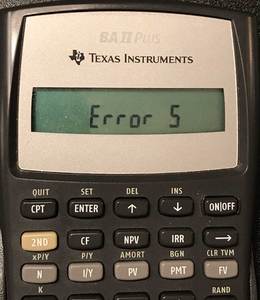

While I was studying for the CFA exam, I periodically received an error 5 message while practicing time value of money problems on the BA II plus calculator.

Usually it was because I accidentally hit a wrong button, but it happened frequently enough that I decided to figure what caused the error message in the first place. The easiest way to understand the error message is with an example.

If your taking the CFA exam, don’t miss this detailed BA II plus calculator tutorial for the CFA exam:

Calculating Basic Loan Interest with BA II Plus

The monthly payment on my condo is $926. I originally took out a 30 year, $200,000 mortgage on the property. So what is the interest rate on my mortgage?

I’ll start by showing you the wrong way to do this problem which causes the error 5 message.

- Press 2nd P/Y and input “12” (for 12 payments per year).

- Hit 2nd Quit to exit this screen.

- Input “360” and press N (12 payments per year x 30 years).

- Enter “200,000” and press PV (which represents the mortgage amount)

- Input “926” and press PMT (represents the monthly mortgage payments)

- Calculate the interest rate by pressing CPT and then I/Y.

After you attempt to calculate the interest rate, you will see the error 5 message.

What Causes the Error 5 Message?

The error 5 message is triggered when No Solution Exists for the value you are trying to calculate.

In our mortgage example, we forgot to include a negative sign in front of the monthly mortgage payments. The present value problems require you to correctly label all cash inflows as positive and all cash outflows as negative.

With our example, the monthly mortgage payment is considered a negative cash outflow which means that it should be labeled as “-926” in our example.

Other Possible Causes

There are two more categories of calculator inputs that could cause an error 5 message:

- When using the Time Value of Money, Cash Flow, or Bond worksheets, the logarithm input is not greater than 0 when you try to calculate the value.

- In the Cash Flow worksheet, when solving for the internal rate of return, you forget to include at least one negative cash flow in the list you are solving.

Final Tips

The error 5 message can actually be helpful for you. There are so many different formulas to remember on the CFA exam.

This error message actually provides you with a not so subtle clue that you most likely forgot to label one of your cash flows as a negative.

If you think through the logic of the problem, usually you can figure out which input is most likely the negative cash flow value.

The best way to remember all the formulas and subjects on the exam is to regularly drill with practice questions. All of the best CFA exam prep course providers include large databases of CFA practice questions for the exam.