Planning for retirement is one of the most important undertakings for people as they get older. Yet so many never even do it. One reason is that financial advisors and planners are just too expensive. Another reason, at least historically, has been that there have not been accurate retirement planning applications available for consumers.

Accurate retirement planning entails calculating taxes correctly in every year, handling different account types such as Roth IRAs, 529 plans, Health Savings Account (HSA) plans, and many others. It also involves allowing users to change assumptions on taxes for various cash inflows, allowing for different asset class types for investment holdings, and showing meaningful results such as the probability of never running out of money using Monte Carlo analysis.

There have been a few retirement planning applications for consumers pop up over the past ten to twenty years that have attempted to handle all of the complex factors, but most have failed in one way or another. WealthTrace not only handles nearly all of the complex tax rules and account types, but it also allows users to link their investment accounts such that the balances and holdings update every day.

This review of WealthTrace will go through what WealthTrace offers and why it is so compelling.

Easy Free Trial

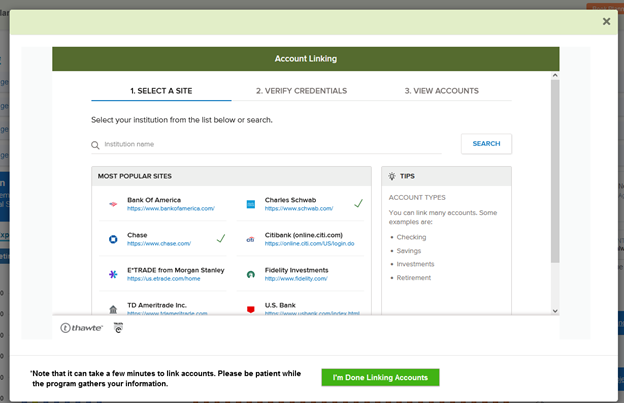

You can sign up for a seven day free trial and get access to every feature WealthTrace has to offer, including the ability to link your investment accounts. The sign up and onboarding process are very easy and you will be looking at plan results in less than 15 minutes. The ability to link accounts makes starting your plan so much easier than manually entering every single investment with every holding and attempting to assign asset classes to them. Users can also start their trial using a mobile phone or tablet as the software is responsive to screen size and is mobile-friendly.

Linking Investment Accounts

The importance of the ability to link investment accounts cannot be overstated. It makes everything so much easier and faster while giving users the most accurate information each day. But there is more to it that just making life easier. By linking investment accounts users can start seeing historical transactions, investment fees they pay, and historical performance on their holdings and their overall accounts. This is powerful information that used to be impossible to come by in one location.

Accurate Results

It has been said many times: garbage in, garbage out. This means that if the inputs and assumptions are not accurate then the results don’t mean much. But it is actually worse than results being meaningless. Bad results can lead to bigtime life decisions, such as retiring early. But if the projections are too rosy and you retire too early, you are in danger of running out of money in retirement.

There are a lot of free “retirement calculators” on the internet and no doubt millions of people use them. But their results should not be trusted. These calculators almost always do not handle the proper calculation of tax rates, historical rates of return on investments, inflation, Required Minimum Distributions (RMDs), savings to individual investment accounts, or Social Security taxes. They also do not allow for rebalancing or reallocating assets over time. But WealthTrace does handle all of this and more.

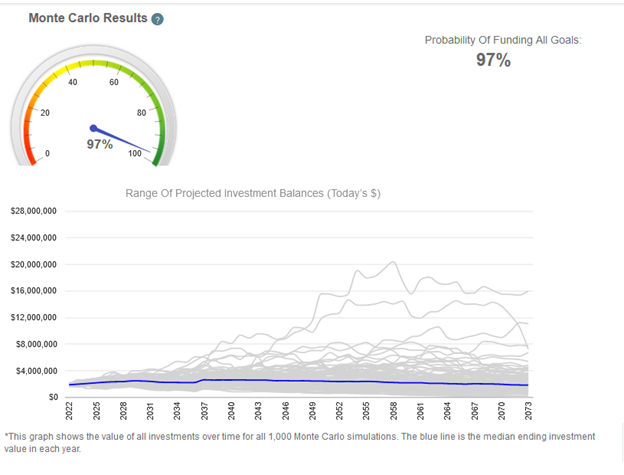

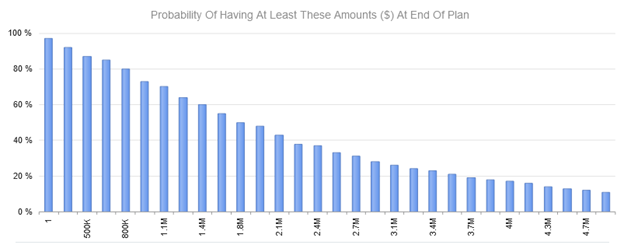

Monte Carlo Analysis

Most retirement calculators and software give a straight line projection of how much money will be left in every year until the end of the plan. But we all know that nothing really moves in a straight line, especially financial markets. That is why Monte Carlo analysis is so important. Monte Carlo calculations in a retirement plan involve running hundreds or even thousands of scenarios where investment returns move up and down based on their historical returns, volatility, and correlation with other assets in the plan. The analysis then involves looking at each scenario, if the user runs out of money in the scenario, and then takes the percent of the time they do not run out of money. This is an extremely important number because it takes into account the risk a portfolio has while at the same time taking into account how diversified the portfolio is.

This calculation involves a lot of math and a lot of information, which is why most retirement planning applications don’t handle it. It also involves knowing which asset class each holding should be assigned to, which is one more reason why having accounts linked and updated is so important.

Scenarios

Another feature that sets WealthTrace apart is its scenario capabilities. Users can quickly find out how their plan holds up if they retire earlier, spend more money on travel, save more or less to a 401(k) plan, or if inflation is higher than expected.

The software also features powerful what-if scenarios for Roth conversions, taxes changing in the future, what-if recession analysis, and asset allocation planning.

Performance Tracking For Holdings

By utilizing the information coming from linked accounts along with Morningstar data, WealthTrace shows historical performance for every mutual fund and Exchange Traded Fund (ETF) that exists. Users can view Year-To-Date performance on their funds as well as historical 1 year, 3 year, 5 year, and 10 year performance numbers. Users can also compare funds against each other to see which ones have performed better over various time frames.

Fees Paid On Funds

The fees that investors pay on funds is often overlooked. But they shouldn’t be. High fees can cost investors thousands of dollars over time and can mean the difference between retiring early or working until you’re too old to travel. WealthTrace quickly and easily shows which funds users are paying the most fees on. Sort by expense ratio or total dollars paid for fees and quickly home in on which funds are costing you the most money.

Parting Thoughts

Financial and retirement planning have come a long way since the internet burst onto the scene. Nearly everybody can now build their own retirement plan and be empowered to track their progress over time. With a program like WealthTrace we no longer have to hire an expensive financial advisor and wait days on end for a call back when we want a simple retirement scenario run.