If you’ve looked into becoming an accountant, you will likely have seen one or both of these titles and wondered whether the Chartered Accountant (CA or ACA) or Certified Public Accountant (CPA) licenses would best serve your career goals.

Chartered Accountant (CA) and Certified Public Accountant (CPA) licenses both authenticate your ability to file tax returns and provide services as a professional accountant.

Their requirements vary by location, but they are similarly rigorous, signify similar knowledge bases, and ultimately lead to comparable careers in financial services.

However, generally speaking, Chartered Accountants work outside of the U.S. or with non-U.S. companies, while CPAs are licensed to work within specific U.S. states.

Before embarking on either journey, it’s important to understand the investment required and what is entailed to achieve these designations as well as the ultimate benefits of finishing either program.

This guide will help explain the process and outcome of each license and help you decide which is best for your career.

CPA: What’s involved?

The CPA process is managed by the American Institute of Certified Public Accountants (AICPA), which lays out specific education, work experience, and examination requirements.

- Compare the Best CPA Exam Review Course options.

The AICPA organizes these requirements into three Es: Education, Experience, and Examination. Of the three, only examination is standardized across the board. The other CPA requirements vary by jurisdiction, of which there are currently 55, including all U.S. states and some territories.

In many ways, the CPA designation operates like the bar exam does for lawyers: licensed CPAs are certified to perform professional accounting, auditing and tax services within a particular U.S. state.

Generally, this is what it takes to become a licensed CPA:

- Meet pre-requirements.

- Complete education requirements for your state (usually a bachelor’s degree or 120 credit hours of undergraduate study).

- Pass all four pieces of the CPA exam within 18 months.

- Work in a professional capacity as an accountant (for about one year, depending on your state).

- Complete other obligations (for example, some states require an ethics exam).

- Complete 40 credits of continuing education per year to maintain your designation.

Education & Pre-test

To be eligible for the CPA exam, you must be at least 18 years old. In nearly all states, you must also have a valid social security number and be a U.S. citizen.

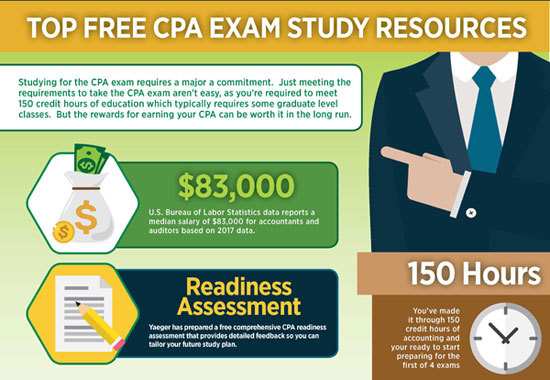

All states require at least a bachelor’s degree, or at least 120 hours of undergraduate coursework. Some states require more (about 150 hours), and some require your work to be focused on accounting, finance, or business.

Nearly all states require at least 24 credit hours to be focused on intermediate and advanced accounting and taxation, and 20 of these credits might need to business or law-related.

You do not need a graduate degree, though graduate programs can count towards this total. You cannot sit the exam until you have completed all educational requirements.

For more information, see the AICPA site.

CPA Exam

After fulfilling these requirements, you can sit the CPA exam. The exam is offered during four two-month long CPA testing windows each year.

The CPA exam includes four separate sections which together take 14 hours to complete:

- Auditing and Attestation

- Business Environment and Concepts

- Financial Accounting and Reporting

- Regulation

All questions are a mixture of multiple choice, task-based simulations, and written communication. You can take the sections in any order: they take a combined total of 14 hours to finish.

However, you must pass all four CPA exam sections (attaining a score of at least 75 out of 90) within the same 18 month period.

The AICPA practice test is a useful free resource, but successful test-taking requires significant preparation. Many CPA candidates use a CPA test bank product to practice exam questions in conjunction with a CPA study plan.

Work Experience

Nearly every state requires work experience in addition to passing the CPA exam. The average is about two years of practical work in government, industry, or public accounting roles.

Aspiring CPAs are typically hired by accounting firms or in-house company accounting departments. Some states will also require you to jump through other hoops before receiving a license such as an ethics exam.

Continuing Education

After you finally have your license, you will likely be required to complete CPA continuing education requirements – usually, about 40 additional credits of study per year. However, the costs of these credits are often covered by your employer.

Chartered Accountant: What’s Involved?

Chartered Accountants were the first accounting organization, established in Scotland in the mid-1800s. Today, many different countries have their own institutes, each offering a distinct pathway to the Chartered Accountant (CA or ACA) license.

This track is quite variable due to the multiple governing bodies overseeing the process. However, many countries do have reciprocity agreements in place. For example, if you receive a CA license in Canada, Australia, New Zealand or some other countries, you may still be allowed to practice in the United States like a CPA.

Your path to the charter will also depend on your educational and professional background. The CA licensing process is designed as a post-graduate program, often set up as an on-the-job internship for accounting professionals who have completed relevant undergraduate training.

However, there are also educational options for college-leavers who want to learn “on the job:” this option understandably requires more years of on the job experience to complete.

Exam Requirements

In addition to educational requirements, you must complete post-graduate training culminating in three levels of examination: The first, “certificate level” includes six modules assessed online.

The second “professional” stage requires six written papers, and the final advanced stage requires two technical integration papers and a case study. These three exams are taken separately and aspiring CAs typically complete work experience while studying to pass each of these exams.

The work experience required varies between three and five years and must take place with an employer which is recognized and approved by the institute.

There are fewer than 3,000 of these in the world. Licensure is almost always granted exclusively after graduation from an accredited program, but the actual licensing requirements vary by country.

Which is better for my career?

Both licenses offer comparative salary ranges and large upward mobility: established professional accountants with either CA or CPA designations make upwards of $150,000 per year, and the median salary for these roles in 2016 was $73,000.

Your salary will depend largely on the country and industry you work in, not the designation you achieve.

As far as knowledge base and responsibilities are concerned, there is also very little difference. If you are a CPA or CA, you can find employment in a number of industries including government, industry, and public accounting firms.

Both CPAs and CAs focus on providing financial services for clients – either personal, small business or large corporations.

Which takes longer? Which is more expensive?

Again, this varies. The CPA requires about five years of college education, an average of 1-2 years of work experience, and then 18 months of examination, for a total of 7-9 years.

Not including educational costs, the licensing can cost between $2,000 and $5,000 depending on how much you spend on exam prep.

The CA designation is very different depending on location. If you begin the program with no college schooling, it will require at least five years of experience on top of your examinations.

If you are a university grad, it might be faster, taking only three years to complete the licensing process. If you are already an accounting professional, it might take even less time. The fees also range drastically and are often paid by your employer.

Bottom line

There is enough overlap in these certificates that you will likely not need both. In addition, Britain, Ireland, India, Canada, Australia, New Zealand, and Mexico all have reciprocity agreements with the United States – if you have the CA designation, you will likely be able to take a CPA equivalency exam to work in the U.S.

If your ideal role would take you outside the United States to work for international companies which aren’t traded on US markets, you likely would find the Chartered Accountant certification more relevant. If you want to work in the US, you will most likely want to become a licensed CPA.