Certified Public Accountant (CPA) and Chartered Financial Analyst (CFA) represent two of the most prestigious professional designations in accounting and finance.

Although these two designations frequently represent divergent career paths, many students evaluate the merits of a career in both accounting or finance when consider their own career path.

As part of that evaluation, it is important to understand each designation and the potential career benefits. This article will explain the similarities and differences of each designation.

Certified Public Accountant

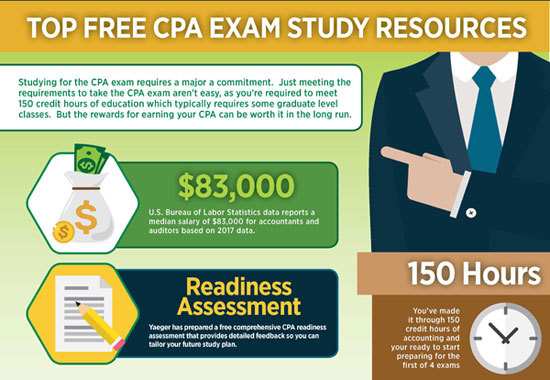

A Certified Public Accountant is licensed at the state level to provide accounting services. Although there is some variation in the CPA licensing requirements of each state, the general requirements include completing 150 credit hours of accounting, passing each of the 4 levels of the CPA exam, having at least one year of professional accounting experience, and meet required continuing education requirements.

Typical career paths include auditing and tax positions at public accounting and private firms.

Chartered Financial Analyst

The CFA Institute awards the Chartered Financial Analyst designation to professionals who have completed three exams and meet the membership and work experience requirements established by the CFA Institute.

The CFA program focuses on investment management, covering broad topics such as financial analysis, fixed income, equity, and derivatives. CFA charterholders typically pursue careers in investment banking, portfolio management, and financial research.

What are the Similarities?

On the surface, these professional designations cover different curriculum and lead to alternative career paths.

However, when you take a closer look, there is significant crossover between the two exams. The CFA exam curriculum focuses very heavily on accounting in the first two levels of the exam.

Financial reporting (accounting) represents 20% of the CFA Level I exam topic weights and it represents 15% to 20% of the level II exam topic weights.

I also found accounting to be one of the hardest sections on the CFA exam. That makes sense because a solid understanding of the accounting that drives changes in corporate financial statements is required to accurately evaluate a business.

A strong accounting background is typically a big factors in the long term success of financial analysts.

How do you Earn the CFA charter?

Earning the CFA charter requires passing three exams administered by the CFA Institute. Each exam is offered annually in June. The three exams are split into three levels which denote the exam content (Level I, Level II, and Level III).

CFA exam level I is the only exam offered twice a year, once in December and once in June. If you took the first exam in December and passed each level, you could complete the process in as early as 2.5 years.

However, it takes most candidates an average of 4 years to pass all three levels of the exam.

Exam Details

Each level of the CFA exam includes a 6 hour test. Level I is composed entirely of multiple choice questions split between a 3 hour morning and a 3 hour afternoon session. There are 240 questions in both the morning and afternoon sessions.

Level II of the CFA exam is composed of 120 questions which are structured in a case study format. There are 10 case studies in the morning and 10 case studies in the afternoon section.

Each case study has 6 questions related to information provided with each case.

The final level of the CFA exam is split between an essay format and a case study section. The essay format occurs during the morning and represents 8 to 12 essay questions to be completed within 3 hours.

The afternoon includes 10 case studies, each with 6 questions with a 3 hour time limit.

The CFA Institute recommends at least 300 hours of study to prepare for each exam level. The exams are very challenging and the only way to pass is with hard word and dedication.

After completing the three exams, you are eligible to become a CFA charterholder if you meet 4 years of required work experience and have a membership in the CFA Institute.

Why should I pursue a CFA designation?

If you’re interested in a career in investment management, the CFA charter offers a potentially less expensive path to a highly competitive career. Earning an MBA can require an investment in excess of $100,000. That could mean additional school loans on top of undergraduate school loans.

In comparison, sitting for the CFA exam requires a one-time fee of $450 and just $650 for each level of the exam (exam fees increase slightly to $950 and $1,380 if you register closer to the exam date).

So you are looking at an investment of approx. $2,400 compared to over $100,000 for an MBA which represents a massive cost saving.

Just keep in mind that the exams are very difficult and you really need to be highly motivated and ready to commit to the necessary hours required to pass the exam.

Historical pass rates are intimidating, but just remember that the low pass rates contribute to the value of the CFA charter in the marketplace. This also contributes to the high average salaries for CFA charterholders.

Although there are no shortcuts to passing the CFA exam, using the right CFA study material was very helpful. I found that regularly practicing CFA test questions was one of the best ways for me to retain the material on the exam.

How do I meet the CPA Requirements?

The requirements for being licensed as a Certified Public Accountant are determined based on the Boards of Accountancy of each state. The specific requirements of each state are included here.

Once you meet the requirements of one state, your typically granted the ability to practice in any state (with a few small exceptions).

In order to sit for the CPA exam, you need to meet the basic educational requirements which include 150 college credit hours. This presents a challenge because most undergraduate accounting programs do not meet the 150 credit hour requirements.

As a result, many students consider taking an additional year of college as part of a graduate level program in order to meet the credit hour requirements.

After meeting the basic education requirements, students are eligible to sit for the CPA exam. The exam is split up into four sections. Students have four hours to complete each exam.

Because of the low pass rates, many CPA candidates use a CPA exam prep course as part of their CPA exam study plan.

The CPA exams are offered during the first two months of each quarter of the year. When you sign up for your first test, you are required to complete all 4 sections within an 18 month window.

If you don’t complete the exam within this 18 month window, you will have to retake each section that exceeds the 18 month mark. The 4 sections of the CPA exam include the following sections:

- Auditing & Attestation (AUD)

- Financial Accounting & Reporting (FAR)

- Regulation (REG)

- Business Environment & Concepts (BEC)

The CPA exam is split up between multiple choice questions and task based simulation questions.

The multiple choice questions are adaptive, meaning they increase in difficulty the more questions you correctly answer. The task based questions are designed for you to apply specific accounting knowledge in a real world context.

Why should I pursue the CPA designation?

Earning the CPA provides a direct path to higher income and opens the door to a variety of career paths. Licensed CPA’s can earn up to 15% more than non-CPA accountants.

It also provides a number of other career benefits which are difficult to quantify, including a greater sense of prestige, credibility, and legitimacy. Even in finance positions for which a CPA isn’t explicitly required, it’s often a determining factor in hiring decisions.

CPAs can serve many different industries and have great deal of versatility and flexibility in terms of career path. They are often better compensated than other accounting professionals and see significant upward mobility.

CFA and CPA: How to apply?

The CFA Institute manages the CFA program and administers the CFA exam. The CFA Institute is based in the U.S., but there are three regional offices and 200 local chapters around the world.

Prospective CFA candidates apply to begin the process through the CFA Institute and the application is relatively simple. As long as you have a bachelor’s degree, you can take level I of the CFA exam. In order to register for level II of the CFA Exam, you need to have completed your bachelors program.

The CPA, in contrast, more stringent eligibility requirements. To start, you must have at least a 4-year bachelor’s degree and in most cases, 150 credit hours (equivalent to 5 years of higher education) to take the CPA exam.

After passing the exam, eligible candidates are granted a CPA license from the state in which they intend to practice. Although the requirements are generally similar, each state has specific requirements that must be met in order to be licensed.

For more information about the CPA exam, see the AICPA site.

Exam Content and Format

CFA Exam

The CFA exam has three levels. Registration fees for the first exam include an electronic study textbook which provides all the information you will – in theory – need to complete the exam.

The CFA exam curriculum focuses on a broad range of topics that include investment management, equity, debt, derivatives, economics, and financial statement analysis.

The Level 1 test is administered twice a year, while Levels 2 and 3 only occur once a year. There are many international test centers for CFA exams in major cities and metropolitan areas around the world.

Although the CFA exam can technically be completed within 18 months (Level 1 in December, Level 2 in June, Level 3 in June of the following year), most candidates take four years (or even more, with re-takes) to complete the exams.

On top of the exams, you must have four years of relevant experience after college to obtain the CFA designation.

In general, it takes more time to earn the CFA charter than to become a licensed CPA.

CPA Exam

The CPA exam, on the other hand, consists of 4 sections. The exam is 100% computerized and consists of multiple-choice questions, task-based simulations (or “study cases”), and written communication.

You can choose to take all four parts of the test individually, two at a time, or even all four at the same time (not recommended).

You can take the exam at any time in the CPA test window, which is the first two months of each quarter, and at any of the Prometric centers across the U.S.

After passing all 4 levels of the CPA exam, you need to meet the requirements of the State Board of Accountancy of the jurisdiction you plan to work in.

CFA vs. CPA – Which is Better?

While some of the curriculum overlaps, CFA charterholders and licensed CPAs generally work in very different professional arenas. Both credentials represent significant accomplishments and can result in significant increases in earnings and career prospects.

The best option for you really depends on your career interests and aspirations. Licensed CPA’s generally focus on accounting careers, either for public accounting companies or in accounting departments at private companies as well as in various government roles.

Chartered Financial Analysts tend to focus on various positions within investment management for large institution investors or private wealth management roles for individual investors.