If you want to position your self for higher earnings and long-term career advancement in accounting, successfully passing the grueling four part CPA exam should be one of your main short term goals.

In order to become eligible to practice as a CPA, you must meet minimum educational and work experience requirements as well as successfully pass the uniform CPA exam. The CPA exam is administered by the American Institute of Certified Public Accountants.

If you want to become a licensed CPA, you will need to meet CPA Exam and license requirements by state and you’ll have to pass not just one, but all four sections in the same 18-month window.

Passing in one try is certainly possible, but will take significant study and preparation. The current pass rates indicate that just slightly more than 50% of people pass the individual sections of the exam.

Before investing significant time, money, and energy in passing all four sections of the CPA exam, it is important to understand how difficult the exam really is.

- Compare the Best CPA Exam Prep Course Options

In addition to being fully comfortable with the content you’ll be tested on, it’s worth understanding the format and structure of the CPA exam itself to have the best chance for success.

- If your struggling with the amount of material on the exam, you might benefit by using a personalized CPA tutor through My Guru.

Here’s an overview of each section of the test and what it takes to pass:

CPA Exam Test Structure

You’ll take each section of the CPA exam separately, with the caveat that you have to pass all four sections within one and a half years of taking the first section.

There are four “testing windows” each year in which you can take any section of the exam – it’s theoretically possible, though very difficult, to complete the whole thing in six months.

Each exam is broken down into five “testlets.” A testlet includes both multiple-choice questions and task-based simulations. In addition to these questions, the BEC section includes writing tasks, and the other three sections all include research-based questions which you’ll need to answer by reading “authoritative literature.”

There is one automatic 15-minute break in the middle of each test. If you decide to take any other breaks during the test, the timer will not stop. It will also take about 10 minutes of admin work before and after the test, so the total testing time is about 4.5 hours.

The first section you get will be “Medium” difficulty by default. Depending on how well you do during this section, you’ll either get another medium section or a difficult section.

This refers to the average difficulty of each question in the section. You’ll get more credit for answering a difficult question correctly. It’s still possible to pass even if you get two medium sections, and you’re not penalized for having more difficult questions.

Multiple-Choice questions are either right or wrong. Task-based simulations, if they aren’t research-based, can be awarded partial credit.

Some of your questions will count toward your exam score, but a small proportion (about 1/6) of the multiple choice and task-based questions are “pretests” which will not count; there’s no way to tell the difference between these questions.

Understanding the Four Sections

Here’s a breakdown of what each section of the test covers. The AICPA also offers a detailed exam blueprint with more information on the exact weight of each section’s content.

Auditing and Attestation Section (AUD)

The AUD section covers the entire auditing process. It includes preparation, risk assessment, obtaining evidence, knowledge of auditing procedures, reporting, and ethical standards.

Here’s a breakdown of the weight given to each of these areas (some questions cover more than one area):

- Ethics, Professional Responsibilities and General Principles: 15-25%

- Assessing Risk and Developing a Planned Response: 20–30%

- Performing Further Procedures and Obtaining Evidence: 30–40%

- Forming Conclusions and Reporting: 15-25%

- Auditing Engagements and Standards: 70-76%

- Professional Responsibilities: 16-20%

- Accounting and Review services: 12-16%

The AUD section typically requires about 100 hours of study depending on prior familiarity and currently has a 52% pass rate.

Business Environment and Concepts (BEC)

The BEC section tests your knowledge of the professional duties of a CPA in a business setting.

The BEC has slightly higher historical pass rates than the other three sections, and covers financial management, corporate governance and risk assessment, financial planning, business communications, and operational management.

The specific breakdown of the BEC’s five topical areas is as follows:

- Corporate Governance 17–27%

- Economic Concepts and Analysis 17–27%

- Financial Management 11–21%

- Information Technology 15-25%

- Operations Management 15-25%

Reference materials relevant to the BEC section of the Exam are included under References at the conclusion of this introduction. Unlike the other sections, the BEC’s final testlet is a writing-prompt which imitates the business memo’s you’d be writing as a professional accountant.

These writing prompts are graded according to organization (structure and order of ideas, including transitions and thesis statements), development (use of supporting evidence, details, examples) and expression (grammar, punctuation, etc.).

They are computer-graded, but will be reviewed by human scorers if you’re on the edge of passing.

This section is generally regarded as the easiest (58% pass rate), and typically requires 50-75 hours of study to pass.

Financial Accounting and Reporting (FAR)

FAR is the longest and typically most challenging section of the CPA exam. It covers a wide variety of regulatory, accounting, and reporting frameworks used by business entities, non-profits, and governmental entities.

You’ll need to be familiar with the standards issues by the Financial Accounting Standards Board, the U.S. Securities and Exchange Commission, AICPA, the Governmental Accounting Standards Board, and the International Accounting Standards Board.

Many of these materials are provided as reference material in the exam, but you will still need deep familiarity with their application in order to pass this section in under four hours.

Here’s the content breakdown:

- Conceptual Framework, Standard-Setting and Financial Reporting 25–35%

- Select Financial Statement Accounts 30–40%

- Select Transactions 20–30%

- State and Local Governments 5–15%

This section requires the most study and is quite challenging, requiring significant endurance to pass within the four-hour window.

It typically takes between 125 and 150 hours of study to pass and has about a 45% pass rate overall.

Regulation (REG)

The Regulation (REG) section of the Uniform CPA Examination (the Exam) tests your knowledge of U.S. federal taxation, business law, and the ethics and professional responsibilities related to tax practice.

Over half of the exam focuses exclusively on federal tax law, with the following areas of focus:

- Ethics, Professional Responsibilities and Federal Tax Procedures 10–20%

- Business law 10–20%

- Federal Taxation of Property Transactions 12–22%

- Federal Taxation of Individuals 15-25%

- Federal Taxation of Entities 28-38%

This section typically requires 75-100 hours of study to pass and has a 53% pass rate.

Most students use a CPA review course to help them prepare.

- Wiley is one of the best CPA prep courses available. The easiest way to find out if Wiley is a good fit for your study style, test it out with a free trial.

- Wiley CPA Prep Course free trial.

What order should I take the CPA test sections?

You can choose to take the exams in any order, and what is best for you will vary depending on your personal situation. However, you can (and should) make this decision strategically.

The FAR is the most comprehensive and difficult and generally requires the most study. If you take it first, then the time it takes you to study for it won’t count against the 18-month window you have to pass all the exam.

Also, the content you learn for it will help you with the other three sections.

Both FAR and AUD overlap with the BEC section. It typically makes sense to take both of them before the BEC. The REG section is the most standalone and can be taken at any time during the process; many people choose to take it last.

So, the typical order would be FAR, AUD, BEC, then REG.

Does the exam get harder or easier over time?

No. The CPA exam is carefully engineered to align with a particular standard – those “pretest” questions which don’t count are used to get a picture of how easy typical candidates find them.

While the pass rate does change a little year by year, this has more to do with how many people take the exam and how well prepared they are than the exam difficulty itself.

The CPA is one of the most difficult professional exams, but student preparedness – i.e. which prep course used, time dedicated to study, etc. – is the biggest predictor of success. It’s definitely worth your time to study the CPA exam and the skills and knowledge required as much as possible to improve your chances.

Taking all the exams once costs an average of $1,000 dollars; if you must retake them multiple times, your investment quickly gets heftier.

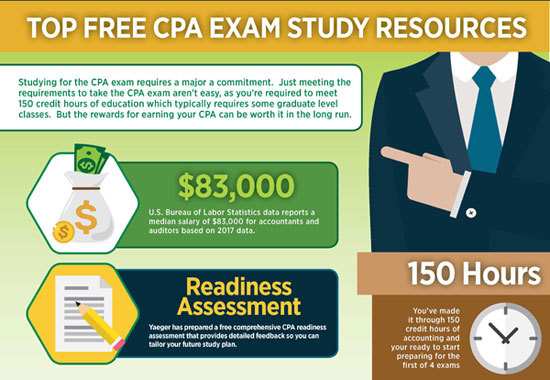

While there are a number of quality free CPA Exam study resources out there, finding the right prep course can save you a ton of time and money.